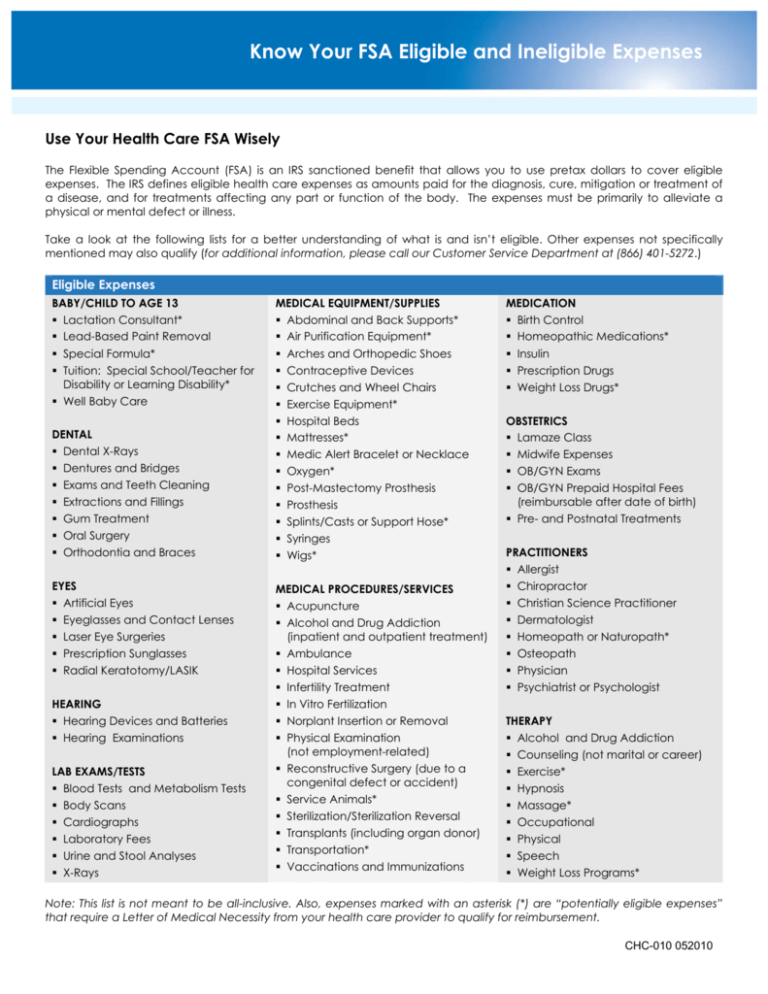

Irs Max Rollover For Fsa 2024. The maximum amount you can contribute to an fsa in 2023 is $3,050 for each qualified account. The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2024.

The irs has announced that the contribution limit for workers who participate in 401 (k), 403 (b), most 457 plans, and the federal government’s thrift. The irs released 2024 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

Irs Max Rollover For Fsa 2024 Images References :

Source: blinniyophelie.pages.dev

Source: blinniyophelie.pages.dev

Irs Max Rollover For Fsa 2024 Corene Rafaelia, The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025.

Source: harriondrea.pages.dev

Source: harriondrea.pages.dev

Fsa Rollover Limits 2024 Ketty Merilee, Employees can now contribute $150 more.

.png) Source: utaqjerrie.pages.dev

Source: utaqjerrie.pages.dev

Fsa Max 2024 Irs Hattie Muffin, The fsa contribution limits increased from 2023 to 2024.

Source: cyblucilia.pages.dev

Source: cyblucilia.pages.dev

Irs Max Rollover For Fsa 2024 Aimil Auberta, Each year the irs allows you to put a maximum amount of money into your fsa.

.png) Source: asiabelisabeth.pages.dev

Source: asiabelisabeth.pages.dev

Irs Max Rollover For Fsa 2024 Kimmy Leontine, Here are the new 2024 limits compared to 2023:

Source: salomawlexis.pages.dev

Source: salomawlexis.pages.dev

Dependent Care Fsa Limit 2024 Irs Tonie Antonietta, The 2024 fsa contributions limit has been raised to $3,200 for employee contributions.

Source: aggybzorana.pages.dev

Source: aggybzorana.pages.dev

2024 Fsa Rollover Limit Collie Sharona, Employers can offer employees participating in health flexible spending accounts (fsas) and dependent care fsas greater flexibility for rolling over unused.

Source: blinniyophelie.pages.dev

Source: blinniyophelie.pages.dev

Irs Max Rollover For Fsa 2024 Corene Rafaelia, In 2024 contributions are capped at $3,200, up from $3,050 in 2023.

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

2024 Fsa Rollover Amount Lory Silvia, Here are the new 2024 limits compared to 2023:

Source: velmaqshelagh.pages.dev

Source: velmaqshelagh.pages.dev

Irs Fsa Max 2024 Joan Ronica, The irs released 2024 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

Posted in 2024